Short Synthetic Futures

Short synthetic futures positions may make sense when you are bearish on the market and uncertain about volatility.

Overview

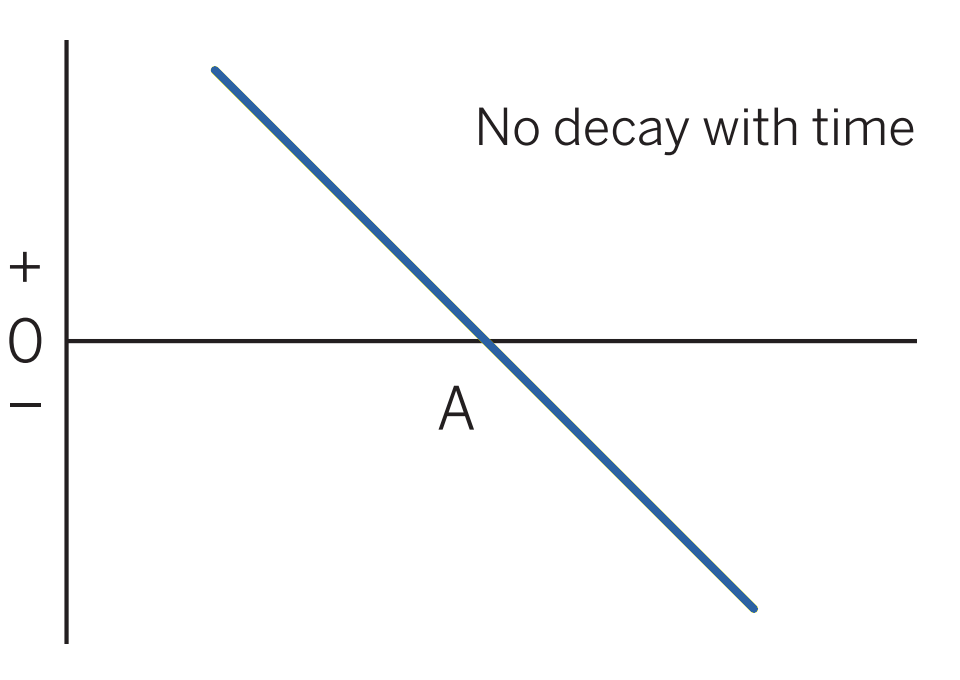

Pattern evolution:

When to use: When you are bearish on the market and uncertain about volatility. You will not be affected by volatility changing. However, if you have an opinion on volatility and that opinion turns out to be correct, one of the other strategies may have greater profit potential and/or less risk. May be traded into from initial short call or long put position to create a stronger bearish position.

Profit characteristics: Profit increases as market falls. Profit is based strictly on the difference between the synthetic entry price and the exit price.

Loss characteristics:

Loss increases as market rises. Loss is based strictly on the difference between the synthetic entry price and the exit price.

Decay characteristics: None.

CATEGORY: Directional

Long put A, short call A

Example

Scenario:

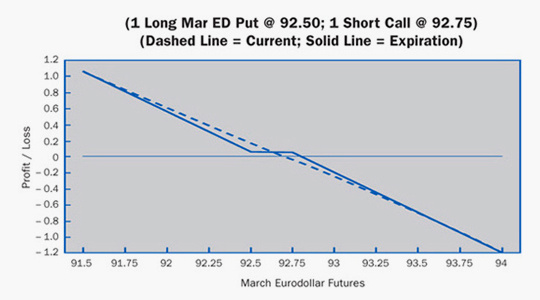

This trader feels that Eurodollar prices are going to drop (interest rates to rise). He has no opinion on volatility. He considers a straight short futures, but decides that there is a slight chance that EuroDollar futures will rise a little. He therefore decides to try a split-strike synthetic short futures position.

Specifics:

Underlying Futures Contract: March Eurodollar futures

Futures Price Level: 92.70

Days to Futures Expiration: 59

Days to Options Expiration: 40

Option Implied Volatility: 23.2%

Option Position:

| Long 1 Mar 92.50 Put | – 0.14 ($ 350) |

| Short 1 Mar 92.75 Call | + 0.20 ($ 500) |

| + 0.06 ($ 150) |

At Expiration:

Breakeven: 92.81 (92.75 strike + 0.06 credit)

Loss Risk: Unlimited; losses mount above 92.81 breakeven.

Potential Gain: Unlimited; profits increase as futures fall past 92.50 strike.

Things to Watch:

Implied volatility changing normally has no effect on this strategy. Therefore, if the trader has an

opinion on volatility, he may find another strategy with a better risk/reward profile. Watch this position carefully; just like a short futures, this position has unlimited risk. Check the next page for follow-up strategies.

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Short Call

- Long Put

- Short Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.