Box or Conversion

Occasionally, a market will get out of line enough to justify an initial entry into one of these positions. However, they are most commonly used to “lock” all or part of a portfolio by buying or selling to create the missing “legs” of the position.

Overview

Pattern evolution:

When to use: Occasionally, a market will get out of line enough to justify an initial entry into one of these positions. However, they are most commonly used to “lock” all or part of a portfolio by buying or selling to create the missing “legs” of the position. These are alternatives to closing out positions at possibly unfavorable prices.

Long box: Long a bull spread, long a bear spread — that is, long call A, short call B, long put B, short put A. Value = B – A – Net Debit.

Short box: Long call B, short call A, long put A, short put B. Value = Net Credit + (A – B).

Long-instrument conversion: Long instrument, long put A, short call A. Value = 0. “Price” = instrument + put – A – call.

Short-instrument conversion: Short instrument, long call A, short put A. Value = 0. “Price” = A + call – instrument – put.

CATEGORY: Locked or arbitrage trade. These spreads are referred to as “locked trades”

because their value at expiration is totally independent of the price of the underlying instrument. If you can buy them for less than that value or sell them for more, you will make a profit (ignoring commission costs).

Example

Scenario:

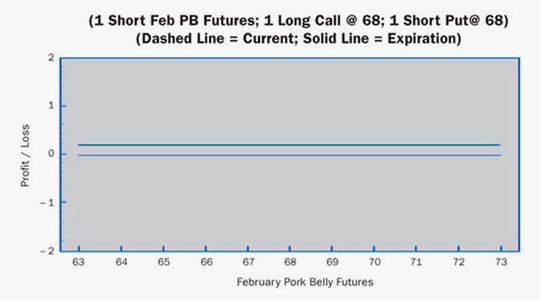

This trader wants to take advantage of mis-pricing between futures and options. There are many ways that combinations of futures and/or options can generate a locked-in profit from mis-pricing. In this case, though, the synthetic long futures (long call + short put at same strike) is cheaper than the under-lying futures. This trader can buy the synthetic futures and sell the actual futures to lock in a profit equal to the mis-pricing.

Specifics:

Underlying Futures Contract: February Pork Bellies

Futures Price Level: 68.30

Days to Futures Expiration: 35

Days to Option Expiration: 10

Option Implied Volatility: Call = 34%; Put 37.5%

Option Position:

| Long 1 Feb 68 Call | – 1.675 ($670.00) |

| Short 1 Feb 68 Put | + 1.550 ($620.00) |

| – 0.125 ($ 50.00) |

| Long: Synthetic Futures | 68.125 |

| Short 1 Feb Futures | 68.300 |

| Locked-In Profit | +0.175 ($ 70.00) |

At Expiration:

Profit is “locked in” with amount received equal to the 0.175 ($70) less commission costs.

Things to Watch:

Rarely will the mis-pricing be great enough for off-floor traders to capitalize on it. Unwinding the position can create problems if all of the positions are not liquidated at exactly the same time. Also, be aware of the possible forced early assignment of the short option.

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Short Call

- Long Put

- Short Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.