Long Strangle

If market explodes either way, you make money; if market continues to stagnate, you lose less than with a long straddle. Also useful if implied volatility is expected to increase.

Overview

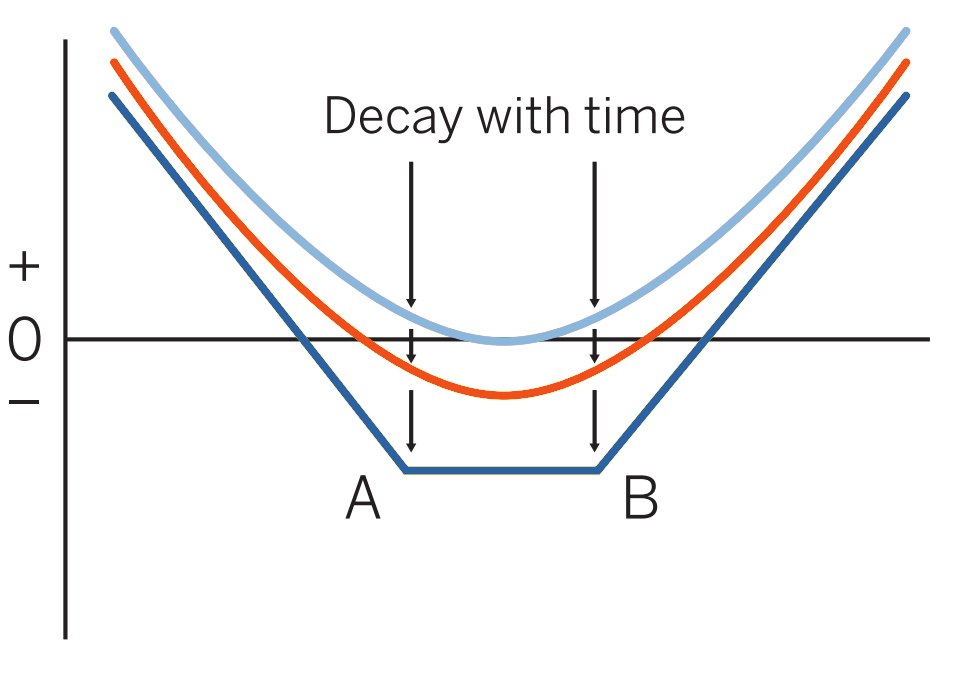

Pattern evolution:

When to use: If market is within or near (A-B) range and has been stagnant. If market explodes either way, you make money; if market continues to stagnate, you lose less than with a long straddle. Also useful if implied volatility is expected to increase.

Profit characteristics: Profit open-ended in either direction. Break-even levels are at A – cost of spread and B + cost of spread. However, spread is usually not held to expiration.

Loss characteristics: Loss limited. Loss is equal to net cost of position. Maximum loss occurs if, at expiration, market is between A and B.

Decay characteristics: Decay accelerates as options approach expiration but not as rapidly as with long straddle. To avoid largest part of decay, the position is normally liquidated prior to expiration.

CATEGORY: Precision

Long put A, long call B

(Generally done to initial delta neutrality)

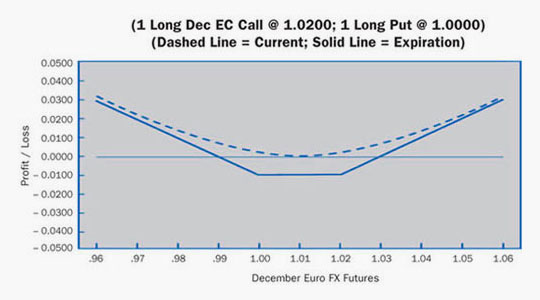

Example

Scenario:

This trader looks at the low implied volatility and feels that options are relatively cheap. The thinking here is that this market will have a very big move. However, the trader is not sure which way it will be, so he decides to buy both a call and a put. The trader saves on premiums by buying both options out-of the-money. However, the trader must get an even larger move than a long straddle to make this strategy profitable by expiration.

Specifics:

Underlying Futures Contract: December Euro FX

Futures Price Level: 1.0100

Days to Futures Expiration: 65

Days to Option Expiration: 55

Option Implied Volatility: 11.3%

Option Position:

| Long 1 Dec 1.0200 Call | – 0.0500 ($ 625.00) |

| Long 1 Dec 1.0000 Put | – 0.0048 ($ 600.00) |

| – 0.0098 ($1225.00) |

At Expiration:

Breakeven: Downside: 0.5002 (1.0000 strike – 0.0098 debit). Upside: 1.0298 (1.0200 strike + 0.0098 debit).

Loss Risk: Losses bottom at 0.0098 with a maximum loss between 1.0200 and 1.0000 strikes.

Potential Gain: Unlimited; gains begin below .9902 and increase as futures fall. Also, gains increase as futures rise past 1.0298.

Things to Watch:

This is primarily a volatility play. A trader enters into this position with no clear idea of market direction but a forecast of greater movement in the underlying futures.

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Short Call

- Long Put

- Short Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Straddle

- Short Straddle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.