Long Call

Use this strategy when you are bullish to very bullish on the market. In general, the more out-of-the-money (higher strike) calls, the more bullish the strategy.

Overview

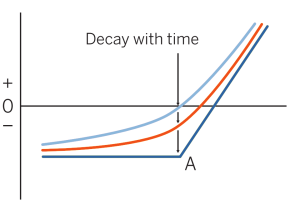

Pattern evolution:

When to use: When you are bullish to very bullish on the market. In general, the more out-of-the-money (higher strike) calls, the more bullish the strategy.

Profit characteristics: Profit increases as market rises. At expiration, break-even point will be call option exercise price A+ price paid for call option.

Loss characteristics: Loss limited to amount paid for option. Maximum loss realized if market ends below option exercise A.

Decay characteristics: Position is a wasting asset. As time passes, value of position erodes toward expiration value.

CATEGORY: Directional

SYNTHETICS: Long instrument, long put

Example

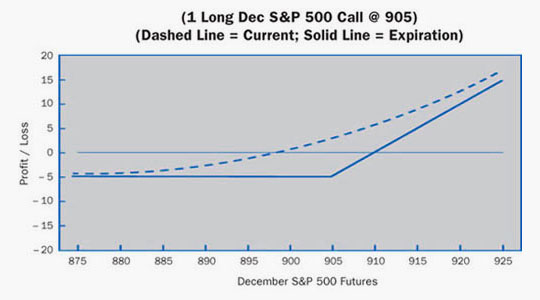

Scenario:

A trader projects that stock market futures are poised for a large upward move in a short period of time. An increase in the underlying futures to 1315.00 or greater, and an increase in implied volatility by 4 percentage points, also seem likely. Consequently, the trader decides to buy a call.

Specifics:

Underlying Futures Contract: December S&P 500

Futures Price Level: 900

Days to Futures Expiration: 45

Days to Options Expiration: 45

Option Implied Volatility: 18.1%

Option Position: Long 1 Dec 905 Call – 5.40 ($1350)

At Expiration:

Breakeven: 910.40 (905 strike + 5.40 premium)

Loss Risk: Below 910.40; with maximum loss, at 905 or below, of 5.40.

Potential Gain: Unlimited; profits continue to increase as futures rise above 910.40.

Things to Watch:

The trader will lose the volatility effect if this position is held to expiration. As soon as implied volatility rises to the expected level the trader may consider liquidating or transforming this position. Check the next page for appropriate follow-up strategies.

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Short Call

- Long Put

- Short Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.