Short Call

When you are bearish on the market. Sell out- of-the-money (higher strike) puts if you are less confident the market will fall, sell at-the-money puts if you are confident the market will stagnate or fall.

Overview

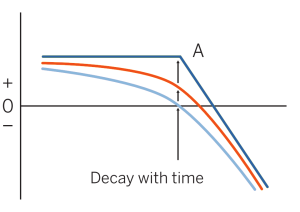

Pattern evolution:

When to use: When you are bearish on the market. Sell out- of-the-money (higher strike) puts if you are less confident the market will fall, sell at-the-money puts if you are confident the market will stagnate or fall.

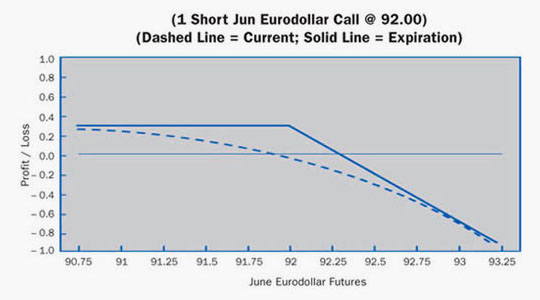

Profit characteristics: Profit limited to premium received. At expiration, break-even is exercise price A + premium received. Maximum profit realized if market settles at or below A.

Loss characteristics: Loss potential is open-ended. Loss increases as market rises. At expiration, losses increase by one point for each point market is above break-even. Because risk is open-ended, position must be watched closely.

Decay characteristics: Position benefits from time decay. The option seller’s profit increases as option loses its time value. Maximum profit from time decay occurs if option is at-the-money.

CATEGORY: Directional

SYNTHETICS: Short instrument, short put

Example

Scenario:

After a large increase this trader now believes the Eurodollar market is in for a consolidation and a mild downward fall. Implied volatility is approaching all-time highs. Premiums, therefore, are relatively large. The trader wants to capture the inflated premium through the sale of one 92.00 call.

Specifics:

Underlying Futures Contract: June Eurodollar

Futures Price Level: 91.97

Days to Futures Expiration: 30

Days to Options Expiration: 30

Option Implied Volatility: 34.4%

Option Position: Short 1 Jun 92.00 Call + 0.30 ($750)

At Expiration:

Breakeven: 92.30 (92.00 strike + 0.30 premium)

Loss Risk: Unlimited; losses continue to increase as futures rise above 92.30 breakeven.

Potential Gain: Limited to the premium received. Maximum profit below 92.00 strike.

Things to Watch:

Although the trader is highly compensated for the risk assumed (with implied volatility high), the trader must watch this (and all) unlimited risk positions closely. Consider another strategy if the futures and/orvolatility continue to rise. A review of the trade should occur at some predetermined place.

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Long Put

- Short Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.