Short Iron Butterfly

Enter when the Short Iron Butterfly’s net credit is 80 percent or more of C – A, and you anticipate a prolonged period of relative price stability where the underlying will be near the mid-point of the C – A range close to expiration. This is a rule of thumb; check theoretical values.

Overview

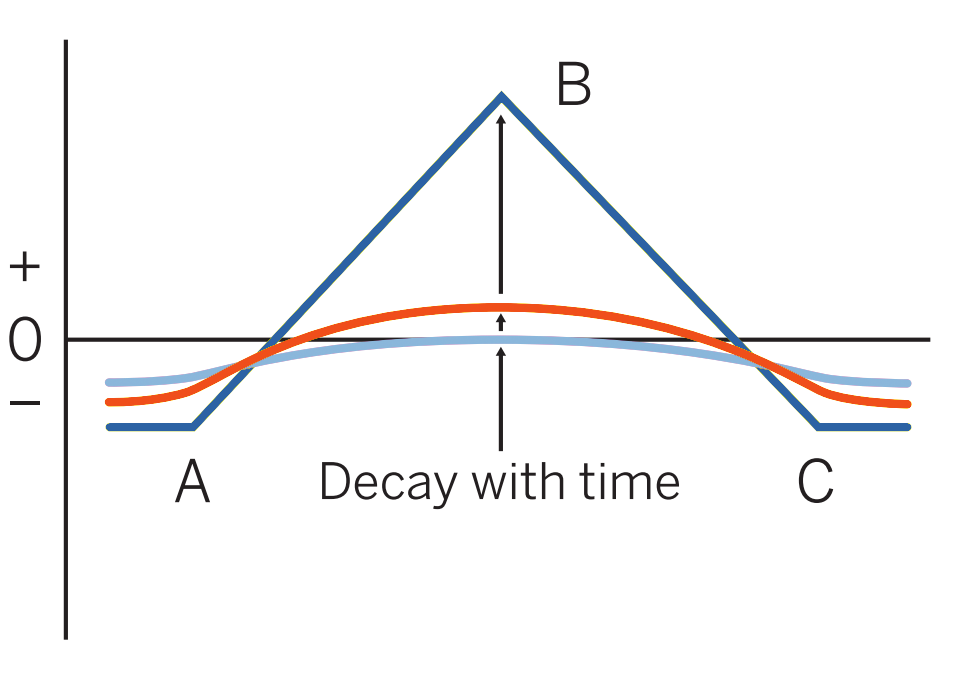

Pattern evolution:

When to use: Enter when the Short Iron Butterfly’s net credit is 80 percent or more of C – A, and you anticipate a prolonged period of relative price stability where the underlying will be near the mid-point of the C – A range close to expiration. This is a rule of thumb; check theoretical values.

Profit characteristics: Maximum profit occurs if a market is at B at expiration. Profit would be equal to short straddle premium minus long strangle premium. This profit develops, almost totally, in the last month.

Loss characteristics: Maximum loss, in either direction, net premium collected minus (B-A). This is a very conservative trade, break-evens are at B + and – net premium collected.

Decay characteristics: Decay negligible until final month, during which distinctive pattern of butterfly forms. Maximum profit growth is at B. If you are away from (A-C) range entering the last month, you may wish to liquidate position.

CATEGORY:Precision

Short 1 call and 1 put at B, buy 1 put at A, buy 1 call at C

or sell straddle at strike price B and buy strangle at AC

for protection

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Short Call

- Long Put

- Short Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.