Bull Spread

Use this strategy if you think the market will go up, but with limited upside. Good position if you want to be in the market but are less confident of bullish expectations.

Overview

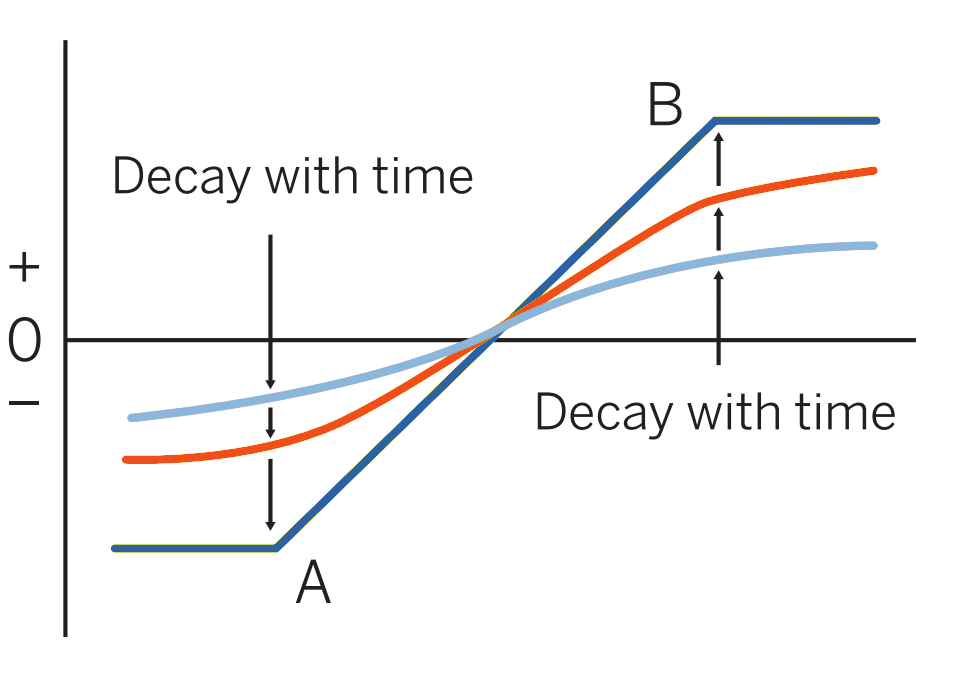

Pattern evolution:

When to use: If you think the market will go up, but with limited upside. Good position if you want to be in the market but are less confident of bullish expectations. You’re in good company. This is the most popular bullish trade.

Profit characteristics: Profit limited, reaching maximum if market ends at or above strike price B at expiration. If call-vs.- call version (most common) used, break-even is at A + net cost

of spread. If put-vs.-put version used, break-even is at B – net premium collected.

Loss characteristics: What is gained by limiting profit potential is mainly a limit to loss if you guessed wrong on market. Maximum loss if market at expiration is at or below A. With call-vs.-call version, maximum loss is net cost of spread.

Decay characteristics: If market is midway between A and B, little if any time decay effect. If market is closer to B, time decay is generally a benefit. If market is closer to A, time decay is generally detrimental to profitability.

CATEGORY: Directional

Long call A, short call B

Long put A, short put B

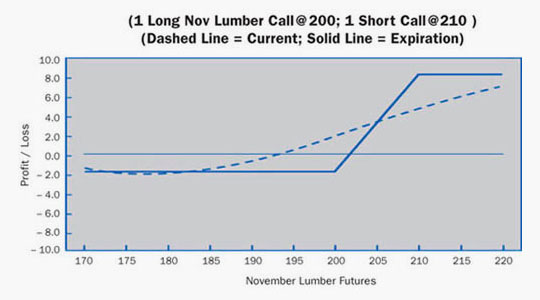

Example

Scenario:

The trader feels bullish on Lumber, but volatility is in question. He could try futures as an alternative, but wants the comfort of a limited loss position. He decides on a bull spread with the higher strike written at the top of his expected trading range of 210.

Specifics:

Underlying Futures Contract: November Lumber

Futures Price Level: 193.00

Days to Futures Expiration: 60

Days to Options Expiration: 40

Option Implied Volatility: 18.6%

Option Position:

| Long 1 Nov 200 Call | – 2.10 ($315) |

| Short 1 Nov 210 Call | + 0.50 ($ 75) |

| – 1.60 ($240) |

At Expiration:

Breakeven: 201.60 (200.00 strike + 1.60 debit)

Loss Risk: Limited to premium paid. Losses increase below 201.60 to a maximum loss below 200.00 of 1.60 ($240).

Potential Gain: Limited to difference between strikes less debit paid (10.00 – 1.60) 8.40 ($12,600). Gains mount above 201.60 with maximum profit at 210.00.

Things to Watch:

Volatility changes affect this spread very little. Therefore, if the trader has an opinion on volatility, one of the other strategies may work better. Check the next page for follow-up strategies.

Additional Futures & Options Strategies

- Long Futures

- Long Synthetic Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Short Call

- Long Put

- Short Put

- Bear Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.