Long Synthetic Futures

When you are bullish on the market and uncertain about volatility. You will not be affected by volatility changing. However, if you have an opinion on volatility and that opinion turns out to be correct, one of the other strategies may have greater profit potential and/or less risk. May be traded into from initial long call or short put position to create a stronger bullish position.

Overview

Pattern evolution:

When to use: When you are bullish on the market and uncertain about volatility. You will not be affected by volatility changing. However, if you have an opinion on volatility and that opinion turns out to be correct, one of the other strategies may have greater profit potential and/or less risk. May be traded into from initial long call or short put position to create a stronger bullish position.

Profit characteristics: Profit increases as market rises. Profit is based strictly on the difference between the exit price and the synthetic entry price.

Loss characteristics: Loss increases as market falls. Loss is based strictly on the difference between the exit price and the synthetic entry price.

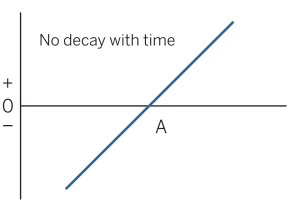

Decay characteristics: None.

CATEGORY: Directional

Long call A, short put A

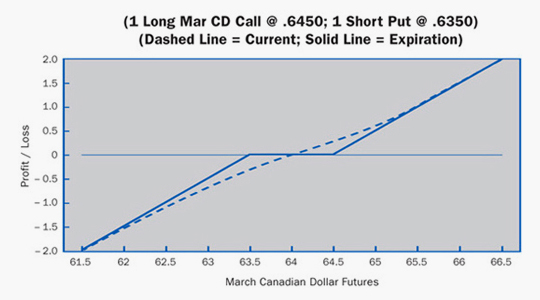

Example

Scenario:

Normally a trader enters into this position only as a follow-up strategy. Suppose the trader had a short strangle that he wanted to convert to a long futures. He can buy 2 calls (one liquidates the original short call). This nearly creates a synthetic long futures (long call, short put); however, it does so at different strike prices. The only difference in the risk/reward profile is the flat area between strik —where little is gained or lost (depending upon the premiums and the exact strikes chosen).

Specifics:

Underlying Futures Contract: March Canadian Dollar

Futures Price Level: .6400

Days to Futures Expiration: 30

Days to Options Expiration: 20

Option Implied Volatility: 5.0%

Option Position:

| Long 1 Mar .6450 Call | – .0020 ($200) |

| Short 1 Mar .6350 Put | + .0019 ($190) |

| – .0001 ($ 10) |

At Expiration:

Breakeven: .6451 (.6450 strike + 0.0001 debit)

Loss Risk: Unlimited; losses mount as futures fall past .6350 strike.

Potential Gain: Unlimited; profits increase as futures rise past .6451 breakeven.

Things to Watch:

This position is not normally affected by changes in implied volatility. It is nearly the same as a long futures position except for the flat area between strikes. The flat area below the current futures price allows for some downside movement without loss. However, the trader gives away a little upside potential. Check the next page for follow-up strategies. Synthetic Long Futures

Additional Futures & Options Strategies

- Long Futures

- Short Synthetic Futures

- Long Risk Reversal

- Short Risk Reversal

- Long Call

- Short Call

- Long Put

- Short Put

- Bear Spread

- Bull Spread

- Long Butterfly

- Short Butterfly

- Long Iron Butterfly

- Short Iron Butterfly

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Call Spread

- Ratio Put Spread

- Ratio Call Backspread

- Ratio Put Backspread

- Box or Conversion

- Futures & Options Strategies Overview

Contents Courtesy of CME Group.